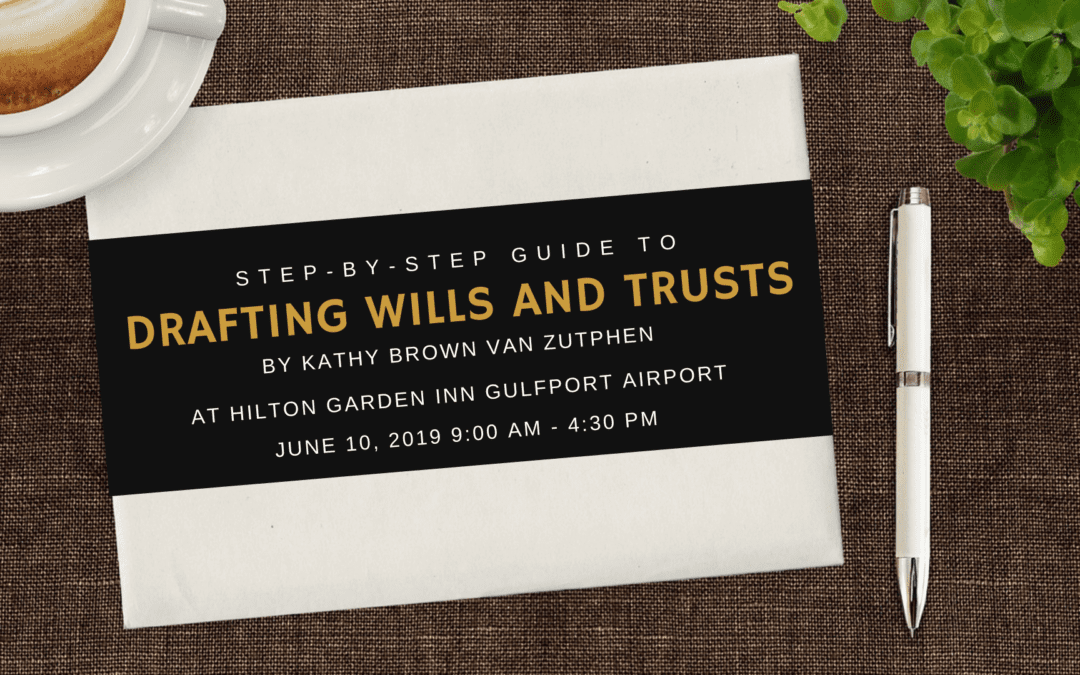

Gulfport: Monday, June 10, 2019

Tupelo: Monday, June 11, 2019

Pearl: Monday, June 12, 2019

Draft Enforceable Estate Planning Documents With These Practical Techniques

Do you have all the information you need to draft customized testamentary documents for each of your clients? Don’t spend years gathering precious bits of legal practice wisdom – our experienced attorney faculty are here to share their time-tested methods of identifying clients’ needs and creating custom-tailored wills and trusts to fit each specific situation. This legal primer offers all the tools and sample forms to get you started. Get the fundamental skills you need to build your estate planning practice – register today!

- Get practical will and trust drafting skills to speed up the process and give the testator’s last wishes power.

- Stave off conflicts of interest with a clear determination of who your client is from the start.

- Learn how to deal with interested relatives who want to be present at all the planning meetings.

- Explore the pros and cons of using a revocable living trust in the will’s stead and find out when it’s a better option.

- Explore the functions and mechanics of major trust structures – and make certain you choose the right tool for each job.

- Give each provision full power with precise word choices – get sample forms to speed up the process.

- Make sure your remarried and unmarried clients know the default inheritance laws and help them make sure the right beneficiaries are assigned.

- Anticipate key tax issues, including individual income tax planning and trust taxation.

- Phrase the fiduciary and beneficiary designations to leave no room for misinterpretation.

- Help your clients make the tough medical decisions regarding long-term care, end-of-life and organ donation.

- Learn how to verify and document the testator’s competency to close the door on any potential will contests.

Who Should Attend

This basic level seminar offers foundational will and trust drafting skills that will benefit:

- Attorneys

- Paralegals

- Trust Officers and Personal Representatives

- Estate Planners

- Accountants and CPAs

- Tax Professionals

Course Content

- Key Elements of Effective Wills

- Trusts as Alternatives to Wills

- Basic Tax Concerns

- Ethics

- Planning for Unmarried and Remarried Couples

- Documenting Long-Term Care, Incapacity and End-of-Life Decisions

Kathy Brown van Zutphen is an attorney licensed to practice law in Alabama and Mississippi. She focuses on the “elder law” areas of trusts, estates, and conservatorships. Additionally, she litigates lawsuits and represents small business owners as part of her legal practice. You can also reach her at her office: (228) 357-5227.