News

We write about legal issues, but we also share information we think you can use in your daily life.

Probate is not the worst thing that can happen

Trusts are a good estate-planning tool. I often say they are an excellent option when a family needs flexibility, such as after a second marriage results in a blended family or when there is a special-needs family member. Trusts provide the ability to control assets from the grave.

Mississippi Heroes Caregiver Luncheon

Mississippi Heroes hosted their first community luncheon for caregivers. Guests enjoyed speakers Kathy Brown van Zutphen and Dr. Tracy Daniel-Hardy, plus were able to network with other caregivers and share resources. More about the event here: WXXV25.com

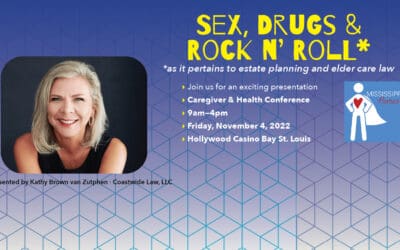

2022 Caregiver and Health Fair Conference

9am — 4pm Friday, November 4 Hollywood Casino Bay St. Louis I am honored to speak at the 2022 MS Heroes Caregiver & Health Fair Conference on November 4th at the Hollywood Casino Gulf Coast. Want to get a lot of great information for anyone who needs to hear from...

Can stepchildren or foster children inherit your estate?

There are three elements you need to consider about the status of your stepchildren or foster children when determining whether they can inherit your estate.

Estate Planning Basics

Despite what you may think, estate planning isn’t just for the elderly. Estate planning is the process in which one plans for the unexpected, whether it be death, disability, or incapacity. In our inaugural episode of “Estate Planning Essentials,” we’ll break down the estate planning basics. From medical directives to memorial instructions, document drafting to trusts, we’ve got you covered.

What Happens When Your Digital Assets Outlive You?

During the estate planning process, it is important to ensure that your fiduciaries (the personal representatives of the estate, trustees, and agents named in the durable power of attorney) have the information necessary to access your assets and manage them in the event of your incapacity or death.

Elder Financial Abuse

The abuse and mistreatment of seniors is not just a matter of neglect or violence. Financial abuse is also all too common, and often, caregivers and family members are the culprits. Learn more about the unfortunate epidemic of elder financial abuse.

Gifts Of Equity Can Produce Unexpected Tax Pitfalls

A sale for less than fair market value involves a partial gift. If the amount of the gift exceeds certain thresholds, the gift would have to be reported by the donor on a gift tax return and it could trigger a gift tax.

Updated 2022 Estate and Gift Tax Rates

Beginning in 2022, the annual gift exclusion will be $16,000 per donor, up from $15,000 in recent years.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Note: Although the IRS has announced that the lifetime estate and gift tax exemption will increase to $12.06 million in 2022, that amount is set to be cut in half at the start of 2026. An earlier version of the Build Back Better Act included a provision that would have cut the exemption in half at the start of 2023 instead, but that was dropped from the November 3 legislative text. It is unclear whether that provision will work its way back into any final legislation. Thus, if one is interested in using his or her higher lifetime gift tax exemption, he or she may want to act fast before any changes to the law are implemented.